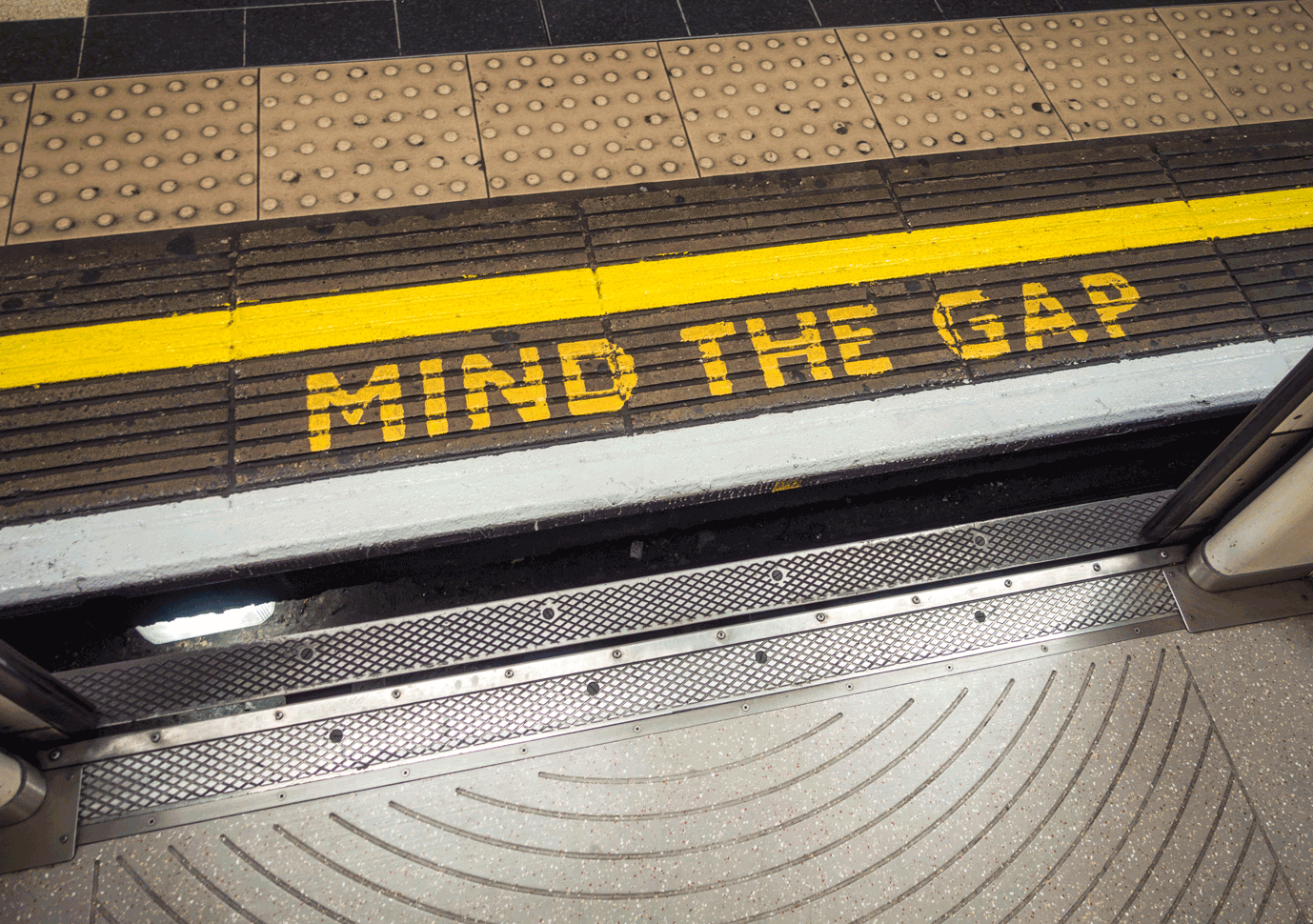

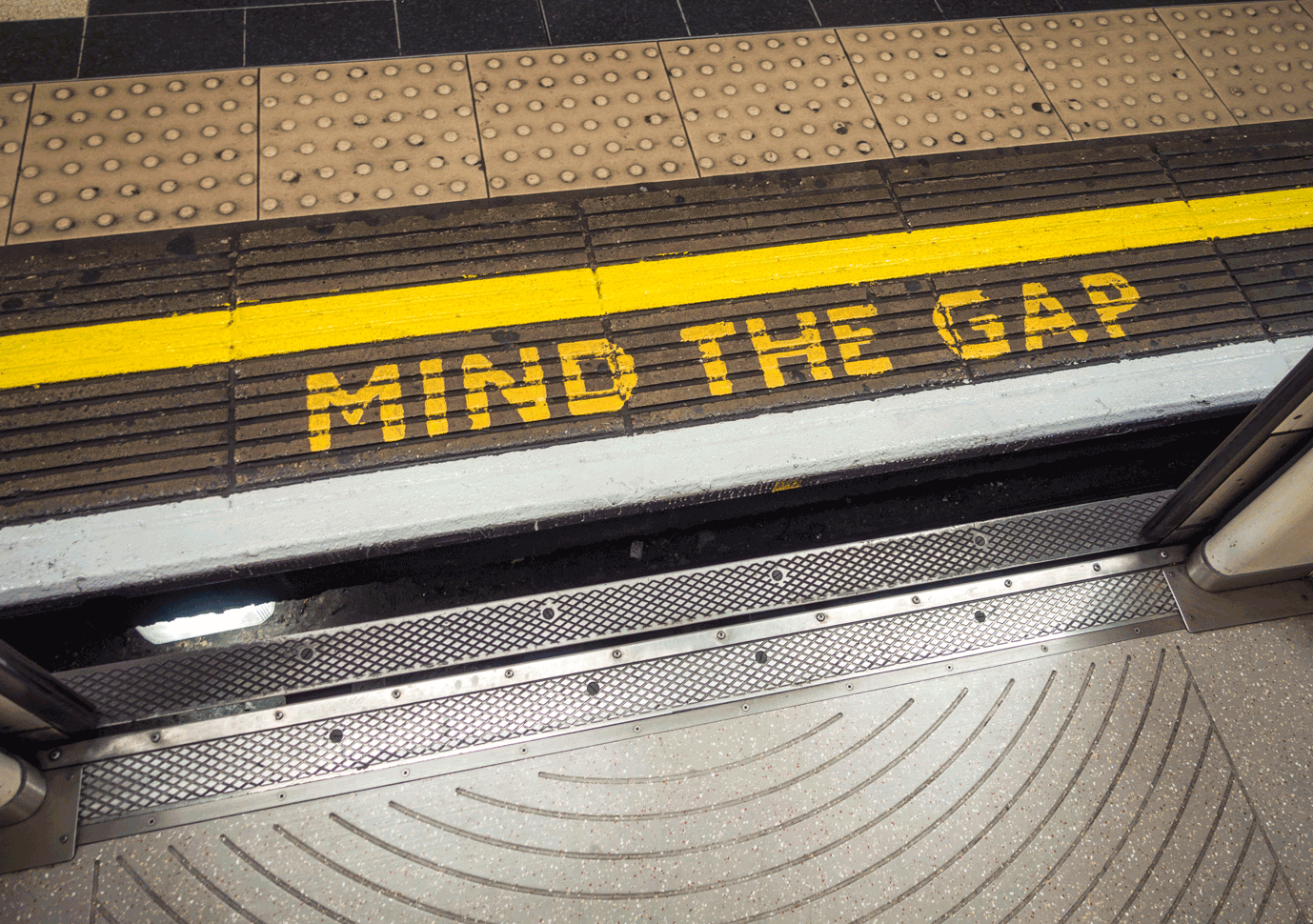

Mind the gap(s)

© Generali Investments, all rights reserved. This website is provided by Generali Investments Holding S.p.A. as the holding company of the main asset management companies of the Generali Group having, directly or indirectly, the majority shareholding in the companies listed below (hereinafter jointly, “Generali Investments”). This website may contain information related to the activity of the following companies: Generali Asset Management S.p.A. Società di gestione del risparmio, Infranity, Sycomore Asset Management, Aperture Investors LLC (including Aperture Investors UK Ltd), Plenisfer Investments S.p.A. Società di gestione del risparmio, Lumyna Investments Limited, Sosteneo S.p.A. Società di gestione del risparmio, Generali Real Estate S.p.A. Società di gestione del risparmio, Conning* and among its subsidiaries Global Evolution Asset Management A/S - including Global Evolution USA, LLC and Global Evolution Fund Management Singapore Pte. Ltd - Octagon Credit Investors, LLC, Pearlmark Real Estate, LLC as well as Generali Investments CEE. *Includes Conning, Inc., Conning Asset Management Limited, Conning Asia Pacific Limited, Conning Investment Products, Inc., Goodwin Capital Advisers, Inc. (collectively, “Conning”).