Plenisfer Investments I The possible prospects for the European telecommunication sector

In Short

Marco Mencini

Head of Research of Plenisfer Investments SGR

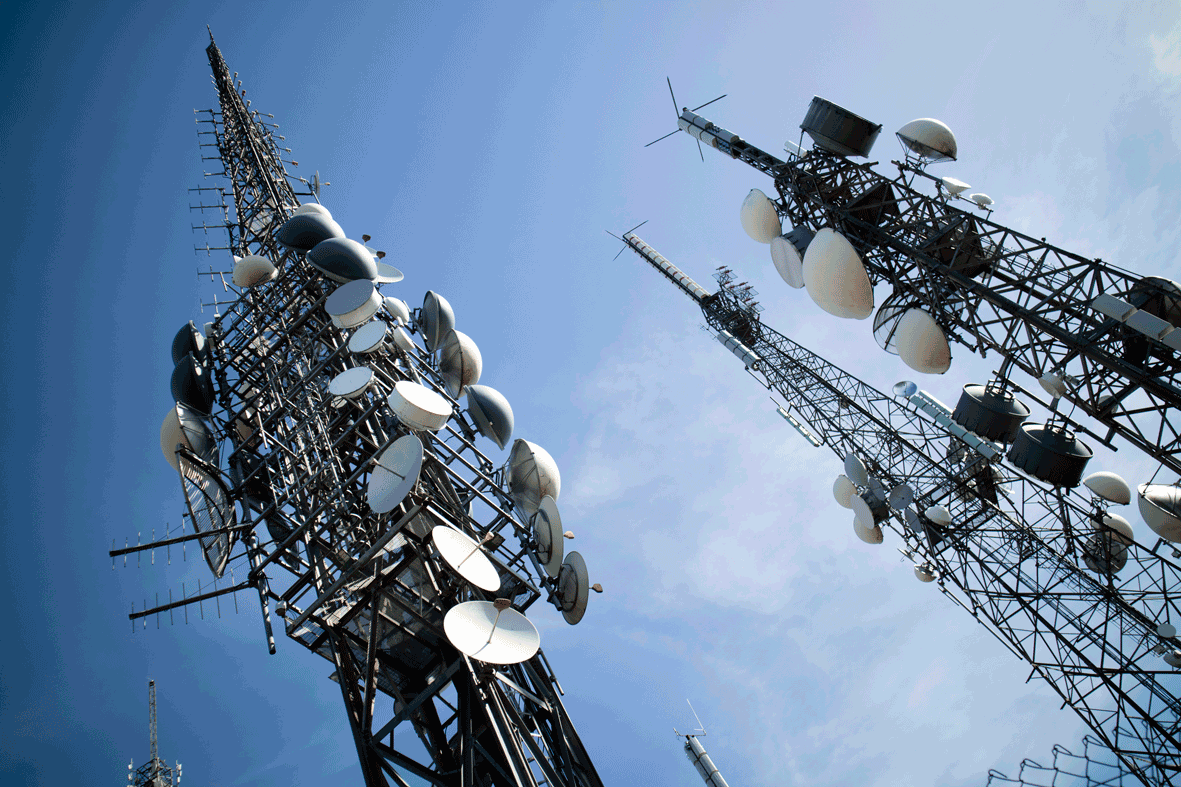

The 2023 will certainly be remembered as the year of artificial intelligence on the technological front. We are still in the exploration phase of the infinite applications of this system, but one thing is certain: to fully express its potential, AI will need infrastructures capable of guaranteeing the maximum reduction in latency, i.e. the time between question and answer of data, indispensable in applications such as autonomous driving. But above all it will need networks capable of supporting an increasingly large flow of data: i.e. in Italy, data traffic on the fixed network has doubled in just three years, going from 25.1 zettabbyte - or a trillion bytes - of 2019 to 46.5 Z bytes in 2022 (source: Agcom communications observatory).

On the strategic infrastructures front, such as networks, Europe is however lagging behind.

In an excessively crowded sector such as the telecommunications (TLCs), in the last twenty years the competition has played out on the prices of the services offered. This dynamic has progressively eroded the margins of the operators, compromising their investment capacity. In the old continent today there are still over 100 operators against the three in the United States where the average prices of services are equal to over $60, a value which can be compared, for example, with the average 25 euros in Italy (Source: Bloomberg).