Aperture Credit Opportunities - Q1 2025 Manager Commentary

In Short

Aperture Credit Opportunities Fund: Commentary for Q1 2025

Q1 RECAP

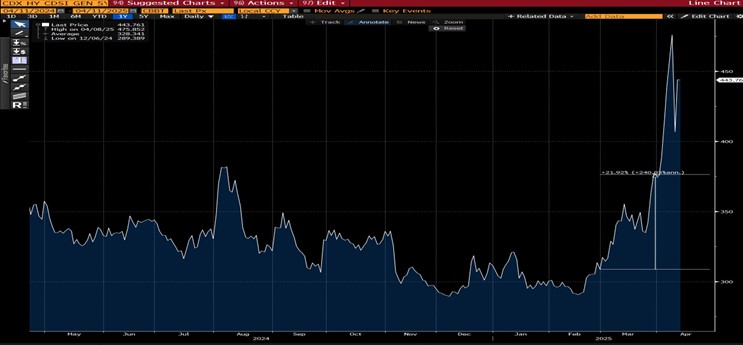

March proved to be a weak month for financial markets across the board. This was particularly the case in the US where concerns over tariffs caused the S&P 500 (Ticker: SPX) to fall 5.4%, and US HY spreads (Ticker: CDX HY CDSI GEN 5Y SPRD Corp) to widen by 65bps. In Europe, the Eurostoxx (Ticker: SX5E Index) fell 4.6%, and HY spreads (Ticker: ITRX XOVER CDSI GEN 5Y Corp) widened 39bps. Against this backdrop, the Aperture Credit Opportunities Fund underperformed the benchmark (please refer to page 2 for specific share class performance).

Mid-month equities slumped to be 10% down from the February high, and although indices recovered, the psychological damage had been done. Most cash bonds held up relatively well during the month as demand for credit remained robust and spreads took the economic-uncertainty strain.

US HY CREDIT SPREAD INDEX – CDX HY

Source: Bloomberg

The most significant detractors from portfolio performance were:

Energy names, such as Borr Drilling (Ticker: BORR US Equity) which is a long position in the portfolio. The bonds fell 5.5pts during March and failed to rally back as the oil price recovered into month-end.

Pro-cyclical retail holdings, such as Saks Global (Ticker: SAGLEN US Equity), a long position which fell 11pts. This loss was, however, partially offset by Macys CDS (Ticker: M US Equity), a short in the portfolio, which widened 110bps.

European credits fared better as seen by Barclays 9.25% AT1 (Ticker: BACR LN Equity), a long holding, which fell only 1.5pts over the month.

Overall, we were slightly disappointed by some of the negative alpha and that the portfolio hedges didn’t perform quite as well as expected. Gross leverage was reduced over the month from 140% to 110% and the beta- adjusted long exposure from 40% to 31%.

We focused on selling names in energy, retail and select European bank positions, and we continued with this strategy into early April, which felt like the correct decision as markets have seen volatility skyrocket and liquidity become a little challenged from the “Liberation Day” fall-out. By month–end the Fund was sitting on 26% cash equivalents.

LOOKING AHEAD

At the time of writing, it is impossible to predict what will happen regarding tariffs and President Trump. If the reduced tariffs remain in place and global investor and consumer confidence in the US continues to decline, then markets will have to price in an increasing likelihood of a recession. This would be negative for credit spreads, and as a result, we anticipate seeing increased outflows across all parts of the credit asset class. Trump’s recent 90-day moratorium on the tariffs has cut off the “left tail” as regards downside risk for now.

If, however, a genuine off-ramp is found, then we would likely see a very strong rebound as investors anticipate a return to “normal economic and market conditions”. We believe that this scenario would be supportive for high yield spreads to regain approximately 75% of what has been lost.

We remain nimble and able to move quickly as opportunities arise within the uncertainty.

Download the commentary:

IMPORTANT INFORMATION

Investments involve risks. Past performance does not predict future return. There can be no assurance that an investment objective will be achieved or that there will be a return on capital. You may not get back the amount initially invested. Before making any investment decision, investors must read the Prospectus, and particularly the specific risks contained in section 6, as well as the Key Investor Information Document (KIID) / Key Information Document (KID) (as applicable to their jurisdiction).

As indicated in the KID accurate as of 13 March 2025, costs: (illustrative share classes: ISIN LU1958553072 registered in AT, CH, DE, ES, IT, LU, PT, UK): Entry charge: up to 3% max, Exit charge: none, Ongoing charge: 0.66% per year. Performance fee: For its services to the Sub-fund, the Investment Manager is entitled to a variable management fee ("VMF"), which is calculated and accrued daily, at the rate stated as the "VMF Midpoint". The VMF Minimum portion of the VMF will be calculated and accrued daily based on the Sub-fund's NAV. The rest of the VMF amount, if any, will be calculated and accrued daily based on the Sub-fund's daily Modified Net Assets, adjusted upward or downward by a performance adjustment (the "Performance Adjustment") that depends on whether, and to what extent, the performance of the Sub-fund exceeds, or is exceeded by, the performance of the Benchmark plus 6.5% (650 basis points) (the "VMF Midpoint Hurdle") over the Performance Period. For a full description of the VMF please see the applicable section in Appendix A contained in the Prospectus.

As indicated in the KID accurate as of 13 March 2025, costs: (illustrative share classes: ISIN LU2713271372 registered in AT, DE, IT, LU, PT, ES, CH, SG, UK): Entry charge: up to 3% max, Exit charge: none, Ongoing charge: 1.07% per year. Performance fee: For its services to the Sub-fund, the Investment Manager is entitled to a variable management fee ("VMF"), which is calculated and accrued daily, at the rate stated as the "VMF Midpoint". The VMF Minimum portion of the VMF will be calculated and accrued daily based on the Sub-fund's NAV. The rest of the VMF amount, if any, will be calculated and accrued daily based on the Sub-fund's daily Modified Net Assets, adjusted upward or downward by a performance adjustment (the "Performance Adjustment") that depends on whether, and to what extent, the performance of the Sub-fund exceeds, or is exceeded by, the performance of the Benchmark plus 6.5% (650 basis points) (the "VMF Midpoint Hurdle") over the Performance Period. For a full description of the VMF please see the applicable section in Appendix A contained in the Prospectus.

This marketing communication is related to Aperture Investors SICAV, an open-ended investment company with variable capital (SICAV) under Luxembourg law of 17 December 2010, qualifying as an undertaking for collective investment in transferable securities (UCITS) and its Sub-Fund, altogether referred to as “the Fund” (Credit Opportunities Fund). This marketing communication is intended only for professional investors in Austria, Switzerland, Germany, Spain, Italy, Luxembourg, Portugal, Singapore, and United Kingdom, where the Fund is registered for distribution, within the meaning of the Markets in Financial Instruments Directive 2014/65/EU (MiFID) and is not intended for retail investors. The Fund has not been registered under the United States Investment Company Act of 1940, as amended, and is not intended for U.S. Persons as defined under Regulation S of the United States Securities Act of 1933, as amended. Aperture Investors UK, Ltd is authorized as Investment Manager in the United Kingdom, regulated by the Financial Conduct Authority (FCA) - 1 Old Queen Street, 1st floor London SW1H 9JA, United Kingdom – UK FCA reference n.: 846073 – LEI: 549300SYTE7FKXY57D44. Aperture Investors, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”), a Commodity Pool Operator registered with the Commodity Futures Trading Commission (“CFTC”) and a member of the National Futures Association (“NFA”). Aperture Investors, LLC wholly owns Aperture Investors UK. In providing investment management services to certain of the Funds, Aperture Investors, LLC draws upon the portfolio management, trading, research, operational and administrative resources of certain of its affiliates (at the present, Aperture UK), including using affiliates to execute transactions for certain Funds. Subject to the written consent of the applicable Fund and the regulatory status of the affiliate, Aperture Investors, LLC treats these affiliates as “participating affiliates,” in accordance with applicable SEC no-action letters and guidance. For a more complete understanding of Aperture’s ownership and control, please see our ADV available here: https://adviserinfo.sec.gov/. Being registered as an investment adviser with the SEC and/or as a Commodity Pool Operator with the CFTC does not imply a certain level of skill or training. For a more complete understanding of Aperture’s ownership and control, please see our ADV available here: https://adviserinfo.sec.gov/.

The Management Company of the Fund is Generali Investments Luxembourg S.A., a public limited liability company (société anonyme) under Luxembourg law, authorised as UCITS Management Company and Alternative Investment Fund Manager (AIFM) in Luxembourg, regulated by the Commission de Surveillance du Secteur Financier (CSSF) - CSSF code: S00000988 LEI: 222100FSOH054LBKJL62.

Generali Asset Management S.p.A. Società di gestione del risparmio is an Italian asset management company regulated by Bank of Italy and appointed to act as marketing promoter of the Fund in the EU/EEA countries where the Fund is registered for distribution (Via Niccolò Machiavelli 4, Trieste, 34132, Italia - Banca d’Italia identification code: 15099 - LEI: 549300DDG9IDTO0X8E20).

This document is co-issued by Generali Asset Management S.p.A Società di gestione del risparmio, Generali Investments Luxembourg S.A. and Aperture Investors UK Ltd.

Before making any investment decision, please read the PRIIPs Key Information Document (PRIIPs KID) or UCITS Key Investor Information Document (KIID) (as applicable to your jurisdiction) and the Prospectus. The PRIIPs KIDs are available in one of the official languages of the EU/EEA country, where the Fund is registered for distribution, and the Prospectus is available in English (not in French), as well as the annual and semi-annual reports at www.generali- investments.lu or upon request free of charge to Generali Investments Luxembourg SA, 4 Rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg, e-mail address: GILfundInfo@generali-invest.com. The Management Company may decide to terminate the agreements made for the marketing of the Fund, in accordance with Article 93a of Directive 2009/65/EC. For a summary of your investor rights in respect of an individual complaint or collective action for a dispute relating to a financial product at the European level and at the level of your EU country of residence, please consult the information document contained in the "About Us" section at the following link: www.generali-investments.com and www.generali- investments.lu. The summary is available in English or in a language authorized in your country of residence.

In the United Kingdom: The Fund is a recognised scheme. This document is a financial promotion, approved for the purposes of Section 21 of the Financial Services and Markets Act 2000, by Aperture Investors UK Ltd. This document is only intended for Professional clients/investors as defined in the UK Conduct of Business Sourcebook (COBS 3.5). The regulation for the protection of retail clients in the United Kingdom and the compensation available under the UK Financial Services Compensation scheme does not apply in respect of any investment or services provided by an overseas person. UK representative: BNP Paribas S.A - FCA reference No: 984625. This product is based overseas and is not subject to UK sustainable investment labelling and disclosure requirements. Learn more about SDR.

In Switzerland: The Sub-Fund has been registered with the FINMA. This document is advertising intended for Swiss investors. Generali Investments Schweiz AG authorized as Management Company in Switzerland, is appointed as Distributor of the Fund in Switzerland - Ombudsman of the Distributor: Ombudsstelle Finanzdienstleister (OFD). The Swiss version of the prospectus and KIIDs are available at www.generali-investments.lu. Swiss Representative/Paying Agent: BNP Paribas, Paris, succursale de Zurich – Ombudsman of the Paying Agent: The Swiss Banking Ombudsman.

Singapore: This document has not been registered as a prospectus with the Monetary Authority of Singapore (“MAS”), nor has it been reviewed by the MAS. No entity with a capital marketing services license has been appointed for the distribution of any funds referred to within this presentation in Singapore. No funds or vehicles referred to in this presentation have been authorised under Section 286 of the Securities and Futures Act (“SFA”) Chapter 289, or recognized under Section 287 of the SFA by the MAS and are therefore not allowed to be offered to the retail public in Singapore. Accordingly, this document may not be circulated or distributed, nor may the funds be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than to "institutional investors" pursuant to Section 304 of the SFA, Chapter 289 of Singapore (the “Act”).

In Portugal, the entity responsible for distribution in Portugal is Banco Best, a credit institution registered with the Banco de Portugal and Portuguese Securities Market Commission (CMVM), authorised to perform banking activities to provide the service of investment referred to in a) of the Article 290 no. 1, Securities Code - CMVM n°: 20161271.

In Spain: Aperture Investors SICAV is a Foreign Collective Investment Scheme registered with the National Securities Market Commission (Comisión Nacional del Mercado de Valores) under registration number 1797.

This marketing communication is not intended to provide an investment, tax, accounting, professional or legal advice and does not constitute an offer to buy or sell the Fund or any other securities that may be presented. Any opinions or forecasts provided are as of the date specified, may change without notice, may not occur and do not constitute a recommendation or offer of any investment. Presented information is based on sources and information Aperture considers trustworthy, but such information might be partially incorrect or incomplete. Past or target performance do not predict future returns. There is no guarantee that positive forecasts will be achieved in the future. The value of an investment and any income from it may go down as well as up and you may not get back the full amount originally invested. The future performance is subject to taxation, which depends on the personal situation of each investor and which may change in the future. Please liaise with your Tax adviser in your country to understand how your returns will be impacted by taxes. The existence of a registration or approval does not imply that a regulator has determined that these products are suitable for investors. It is recommended that you carefully consider the terms of investment and obtain professional, legal, financial and tax advice where necessary before making a decision to invest in a Fund.

Generali Investments is a trademark of Generali Asset Management S.p.A. Società di gestione del risparmio, Generali Insurance Asset Management S.p.A. Società di gestione del risparmio, Generali Investments Luxembourg S.A. and Generali Investments Holding S.p.A. - Sources (unless otherwise specified): Aperture and Generali Asset Management S.p.A. Società di gestione del risparmio - This document may not be reproduced (in whole or in part), circulated, modified or used without prior written permission.

For its services to the Sub-fund, the Investment Manager is entitled to a variable management fee ("VMF"), which is calculated and accrued daily, at a rate stated as the ‘VMF Midpoint’ (as applicable to the share class). The VMF Minimum portion of the VMF will be calculated and accrued daily based on the Sub- fund's NAV. The rest of the VMF amount, if any, will be calculated and accrued daily based on the Sub-fund's daily Modified Net Assets, adjusted upward or downward by a performance adjustment (the "Performance Adjustment") that depends on whether, and to what extent, the performance of the Sub-fund exceeds, or is exceeded by, the performance of the Benchmark plus 6.5% (650 basis points) (the "VMF Midpoint Hurdle") over the Performance Period. For a full description of the VMF please see the applicable section in Appendix A contained in the Prospectus.

Net performance assumes reinvestment of dividends and capital gains. For the avoidance of doubt, the Investment Manager may receive a performance fee even in the case of negative performance. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performa nce shown. A fund's performance for very short time periods may not be indicative of future performance. Indices are unmanaged and do not include the effect of fees or expenses. One cannot invest directly in an index. The performance returns represent past performance. Past performance does not guarantee future results.

Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by US Treasury securities. It was selected as a preferred alternative to LIBOR by the US Federal Reserve in June 2017.

Investors should note the specific risk warnings:

Interest Rate Risk - The performance of the strategy may be influenced by changes in the general level of interest rates. Generally, the value of fixed income instrument will change inversely with changes in interest rates: when interest rates rise, the value of fixed income instruments generally can be expected to fall and vice versa. Fixed income securities with longer-term maturities tend to be more sensitive to interest rate changes than shorter-term securities. In accordance with its investment objective and policy, the strategy may attempt to hedge or reduce interest rate risk, generally through the use of interest rate futures or other derivatives. However, it may not be possible or practical to hedge or reduce such risk at all times.

Credit Risk - Investing in fixed income instruments will be exposed to the creditworthiness of the issuers of the instruments and their ability to make principal and interest payments when due in accordance with the terms and conditions of the instruments. The creditworthiness or perceived creditworthiness of an issuer may affect the market value of fixed income instruments. Issuers with higher credit risk typically offer higher yields for this added risk, whereas issuers with lower credit risk typically offer lower yields. Generally, government debt is considered to be the safest in terms of credit risk, while corporate debt involves a higher credit risk. Related to that is the risk of downgrade by a rating agency. Rating agencies are private undertakings providing ratings for a variety of fixed income instruments based on the creditworthiness of their issuers. The agencies may change the rating of issuers or instruments from time to time due to financial, economic, political, or other factors, which, if the change represents a downgrade, can adversely impact the market value of the affected instruments.

Distressed Securities Risk - The strategy may directly or indirectly purchase securities and other obligations of securities and other obligations of companies that are experiencing significant financial or business distress, including companies involved in bankruptcy, insolvency or other reorganization and liquidation proceedings ("Distressed Companies"). Although such purchases may result in significant returns, they involve a substantial degree of risk and may not show any return for a considerable period of time or any return at all. Evaluating investments in Distressed Companies is highly complex and there is no assurance that Aperture will correctly evaluate the nature and magnitude of the various factors that could affect the prospects for a successful reorganization or similar action. In any reorganization or liquidation proceeding relating to a Distressed Company in which the strategy invests, such strategy may lose its entire investment or may be required to accept cash or securities with a value less than its original investment.

In addition, distressed investments may require active participation of the strategy and/or its representatives and this may expose the strategy to litigation risks or restrict its ability to dispose of its investments. Under such circumstances, the returns generated from the strategy’s investments may not compensate investors adequately for the risks assumed. There are a number of significant risks when investing in Distressed Companies that are or may be involved in bankruptcy or insolvency proceedings, including adverse and permanent effects on an issuer, such as the loss of its market position and key personnel, otherwise becoming incapable of restoring itself as a viable entity and, if converted to a liquidation, a possible liquidation value of the company that is less than the value that was believed to exist at the time of the investment. Many events in a bankruptcy or insolvency are the product of contested matters and adversary proceedings that are beyond the control of the creditors. Bankruptcy or insolvency proceedings are often lengthy and difficult to predict and could adversely impact a creditor's return on investment. The bankruptcy and insolvency courts have extensive power and, under some circumstances, may alter contractual obligations of a bankrupt company. Shareholders, creditors, and other interested parties are all entitled to participate in bankruptcy or insolvency proceedings and will attempt to influence the outcome for their own benefit. Administrative costs relating to bankruptcy or insolvency proceedings will be paid out of the debtor's estate prior to any returns to creditors. Also, certain claims, such as for taxes, may have priority by law over the claims of certain creditors.

Credit Default Swaps ("CDS") Risk - A CDS is a bilateral financial contract in which one counterpart (the protection buyer) pays a periodic fee in return for a contingent payment by the protection seller following a credit event of a reference issuer. The protection buyer must either sell particular obligations, issued by the reference issuer at their par value (or some other designated reference or strike price) when a credit event occurs or receive a cash settlement based on the difference between the market price and such reference or strike price. A credit event is commonly defined as bankruptcy, insolvency, receivership, material adverse restructuring of debt, or failure to meet payment obligations when due. The ISDA has produced standardized documentation for these transactions under the umbrella of its ISDA Master Agreement. As protection seller, the strategy will seek a specific credit exposure to the reference issuer – selling protection (by mitigating the counterparty risk) is economically equivalent to buying a maturity matching floating rate note on the same reference entity. As protection buyer, the strategy may seek either to hedge a specific credit risk of some issuers in the portfolio or to exploit a negative view on a given reference entity. When these transactions are used in order to eliminate a credit risk in respect of the issuer of a security, they imply that the strategy bears a counterparty risk in respect of the protection seller. This risk is, however, mitigated by the fact that the strategy will only enter into CDS transactions with highly rated financial institutions. CDS used for a purpose other than hedging, such as for efficient portfolio management purposes or if disclosed in relation to the strategy, as part of the principal investment policy, may present a risk of liquidity if the position must be liquidated before its maturity for any reason. The strategy will mitigate this risk by limiting in an appropriate manner the use of this type of transaction. Furthermore, the valuation of CDS may give rise to difficulties which traditionally occur in connection with the valuation of OTC contracts. Insofar as the strategy uses CDS for efficient portfolio management or hedging purposes, investors should note that such instruments are designed to transfer credit exposure of fixed income products between the buyer and seller. The strategy would typically buy a CDS to protect against the risk of default of an underlying investment, known as the reference entity and would typically sell a CDS for which it receives payment for effectively guaranteeing the creditworthiness of the reference entity to the buyer. In the latter case, the strategy would incur exposure to the creditworthiness of the reference entity but without any legal recourse to such reference entity. In addition, as with all OTC derivatives, CDS expose the buyer and seller to counterparty risk and the strategy may suffer losses in the event of a default by the counterparty of its obligations under the transaction and/or disputes as to whether a credit event has occurred, which could mean the strategy cannot realize the full value of the CDS.

Contingent Capital Securities (CoCos) Risk - In the framework of new banking regulations, banking institutions are required to increase their capital buffers and have therefore issued certain types of financial instrument known as subordinated contingent capital securities (often referred to as "CoCo" or "CoCos"). The main feature of a CoCo is its ability to absorb losses as required by banking regulations, but other corporate entities may also choose to issue them. Under the terms of a CoCo, the instruments become loss absorbing upon certain triggering events, including events under the control of the management of the CoCo issuer which could cause the permanent write-down to zero of principal investment and/or accrued interest, or a conversion to equity. These triggering events may include (i) a deduction in the issuing bank's capital ratio below a pre-set limit, (ii) a regulatory authority making a subjective determination that an institution is "non-viable" or (iii) a national authority deciding to inject capital. Furthermore, the trigger event calculations may also be affected by changes in applicable accounting rules, the accounting policies of the issuer or its group and the application of these policies. Any such changes, including changes over which the issuer or its group has a discretion, may have a material adverse impact on its reported financial position and accordingly may give rise to the occurrence of a trigger event in circumstances where such a trigger event may not otherwise have occurred, notwithstanding the adverse impact this will have on the position of holders of the CoCos. Upon such occurrence, there is a risk of a partial or total loss in nominal value or conversion into the common stock of the issuer which may cause the strategy as a CoCo bondholder to suffer losses (i) before both equity investors and other debt holders which may rank pari passu or junior to CoCo investors and (ii) in circumstances where the bank remains a going concern. The value of such instrument may be impacted by the mechanism through which the instruments are converted into equity or written down which may vary across different securities which may have varying structures and terms. CoCo structures may be complex, and terms may vary from issuer to issuer and bond to bond. CoCos are valued relative to other debt securities in the issuer's capital structure, as well as equity, with an additional premium for the risk of conversion or write-down. The relative riskiness of different CoCos will depend on the distance between the current capital ratio and the effective trigger level, which once reached would result in the CoCo being automatically written down or converted into equity. CoCos may trade differently to other subordinated debt of an issuer which does not include a write-down or equity conversion feature which may result in a decline in value or liquidity in certain scenarios.

It is possible in certain circumstances for interest payments on certain CoCos to be cancelled in full or in part by the issuer, without prior notice to bondholders. Therefore, there can be no assurance that investors will receive payments of interest in respect of CoCos. Unpaid interest may not be cumulative or payable at any time thereafter, and bondholders shall accordingly have no right to claim the payment of any foregone interest which may impact the value of the strategy. Notwithstanding that interest not being paid or being paid only in part in respect of CoCos or the principal value of such instruments may be written down to zero, there may be no restriction on the issuer paying dividends on its ordinary shares or making pecuniary or other distributions to the holders of its ordinary shares or making payments on securities ranking pari passu with the CoCos resulting in other securities by the same issuer potentially performing better than CoCos. Coupon cancellation may be at the option of the issuer or its regulator but may also be mandatory under certain European directives and related applicable laws and regulations. This mandatory deferral may be at the same time that equity dividends and bonuses may also restricted, but some CoCo structures allow the bank at least in theory to keep on paying dividends whilst not paying CoCo holders. Mandatory deferral is dependent on the amount of required capital buffers a bank is asked to hold by regulators. CoCos generally rank senior to common stock in an issuer's capital structure and are consequently higher quality and entail less risk than the issuer's common stock; however, the risk involved in such securities is correlated to the solvency and/or the access of the issuer to liquidity of the issuing financial institution. The structure of CoCos is yet to be tested and there is some uncertainty as to how they may perform in a stressed environment. Depending on how the market views certain triggering events, as outlined above, there is the potential for price contagion and volatility across the entire asset class. Furthermore, this risk may be increased depending on the level of underlying instrument arbitrage and in an illiquid market, price formation may be increasingly difficult.

Rule 144A and Regulation S Risk - SEC Rule 144A provides a safe harbor exemption from the registration requirements of the US Securities Act of 1933 for resale of restricted securities to qualified institutional buyers, as defined in the rule. Regulation S provides an exclusion from registration requirements of the US Securities Act of 1933 for offerings made outside the United States by both US and foreign issuers. A securities offering, whether private or public, made by an issuer outside of the United States in reliance on Regulation S need not be registered. The advantage for investors may be higher returns due to lower administration charges. However, dissemination of secondary market transactions is limited and might increase the volatility of the security prices and, in extreme conditions, decrease the liquidity of a particular security.

Foreign Exchange Risk - investing in securities denominated in currencies other than its Reference Currency may be subject to foreign exchange risk. As the assets of each Sub-fund are valued in its Reference Currency, changes in the value of the Reference Currency compared to other currencies will affect the value, in the Reference Currency, of any securities denominated in such other currencies. Foreign exchange exposure may increase the volatility of investmentsrelative to investments denominated in the Reference Currency. In accordance with its investment objective and policy, a Sub-fund may attempt to hedge or reduce foreign exchange risk, generally through the use of derivatives. However, it may not be possible or practical to hedge or reduce such risk at all times. In addition, a Share Class that is denominated in a Reference Currency other than the Reference Currency of the Sub-fund exposes the investor to the risk of fluctuations between the Reference Currency of the Share Class and that of the Sub-fund.

Liquidity Risk - Liquidity refers to the speed and ease with which investments can be sold or liquidated or a position closed. On the asset side, liquidity risk refers to the inability of a Sub-fund to dispose of investments at a price equal or close to their estimated value within a reasonable period of time. On the liability side, liquidity risk refers to the inability of a Sub-fund to raise sufficient cash to meet a redemption request due to its inability to dispose of investments. In principle, each Sub-fund will only make investments for which a liquid market exists or which can otherwise be sold, liquidated or closed at any time within a reasonable period of time. However, in certain circumstances, investments may become less liquid or illiquid due to a variety of factors including adverse conditions affecting a particular issuer, counterparty, or the market generally, and legal, regulatory or contractual restrictions on the sale of certain instruments.

Emerging Markets Risk - Investments in emerging markets carry risks additional to those inherent in other investments. In particular, an investment in any emerging market carries a higher risk than investment in a developed market; emerging markets may afford a lower level of legal protection to investors; some countries may place controls on foreign ownership; and some countries may apply accounting standards and auditing practices which do not necessarily conform with internationally accepted accounting principles.

Derivatives Risk – the Sub-fund(s) may use derivative instruments, such as options, futures and swap contracts and enter into forward foreign exchange transactions. The ability to use these strategies may be limited by market conditions and regulatory limits and there can be no assurance that the objective sought to be attained from the use of these strategies will be achieved. Participation in the options or futures markets, in swap contracts and in foreign exchange transactions involves investment risks and transaction costs to which a Sub-fund would not be subject if it did not use these strategies. If the Investment Managers’ predictions of movements in the direction of the securities, foreign currency and interest rate markets are inaccurate, the adverse consequences to a Sub-fund may leave the Sub-fund in a less favourable position than if such strategies were not used.

Equity Risk - The value of a Sub-fund that invests in equity securities will be affected by changes in the stock markets and changes in the value of individual portfolio securities. At times, stock markets and individual securities can be volatile, and prices can change substantially in short periods of time. The equity securities of smaller companies are more sensitive to these changes than those of larger companies. This risk will affect the value of such Sub-funds, which will fluctuate as the value of the underlying equity securities fluctuates.

Short Exposure Risk - short exposure risk results from short sales achieved through the use of derivatives and includes the potential for losses exceeding the cost of the investment, as well as the risk that the third party to the short sale will not fulfil its contractual obligations.

Sustainable Finance Risk - Sustainable finance is a rapidly developing area. The legal and regulatory framework governing sustainable finance continues to evolve. Whilst there has been a step towards a common standard, there is however still discretion among firms that may result in different approaches to setting and achieving ESG objectives. ESG factors may vary depending on investment themes, asset classes, investment philosophy and subjective use of different ESG indicators governing portfolio construction. The selection and weightings applied may to a certain extent be subjective or based on metrics that may share the same name but have different underlying meanings. ESG information, whether from an external and/or internal source, is, by nature and in many instances, based on a qualitative and judgemental assessment, especially in the absence of well-defined market standards and due to the existence of multiple approaches to sustainable investment. An element of subjectivity and discretion is therefore inherent to the interpretation and use of ESG data. It may consequently be difficult to compare strategies integrating ESG criteria.

ESG information from third-party data providers may be incomplete, inaccurate or unavailable. As a result, there exists a risk of incorrectly assessing a security or issuer, resulting in the incorrect inclusion or exclusion of a security. ESG data providers are private undertakings providing ESG data for a variety of issuers. The ESG data providers may change the evaluation.

Special Purpose Acquisition Companies Risk - A SPAC is a publicly traded company that raises investment capital for the purpose of acquiring an existing company. Prior to the acquisition of a target, the SPAC is effectively a cash holding vehicle for a period of time pre-acquisition, meaning it does not have any operating history or ongoing business other than seeking to acquire an ongoing business and will be subject to equity risk, as well as risks that are specific to SPACs. The risk profile of the SPAC will change if a target is acquired as the opportunity to redeem out of the SPAC at the price it was purchased for lapses upon such acquisition. Generally, post-acquisition there is a higher volatility in price as the SPAC trades as a listed equity. The potential target of the SPAC acquisition may not be appropriate for the relevant Sub-fund or may be voted down by the SPAC shareholders, which foregoes the investment opportunity presented post-acquisition. Similar to smaller companies, companies after the SPAC acquisition may be less liquid, more volatile and tend to carry greater financial risk than stocks of larger companies. Shareholders should be aware that the structure of SPACs can be complex and their characteristics may vary largely from one SPAC to another.

Investment in securities rated below Investment Grade Risk – this risk present greater risk of loss to principal and interest than higher-quality securities.

For further information on risks and costs, please read the Prospectus and KID/KIIDs, available free of charge in English (KID also available in Italian) from Generali Investments Luxembourg S.A., 4 Rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg or at the following e-mail address: GILfundInfo@generali-invest.com.