Capabilities

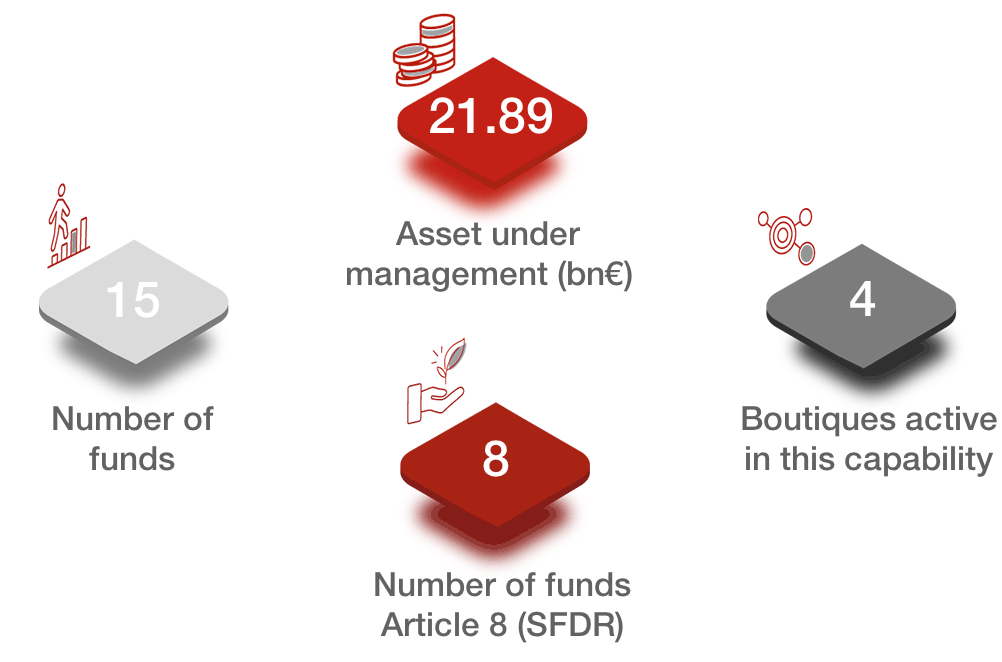

Multi-Asset Solutions

Our multi-asset range offers traditional, balanced strategies and bespoke LDI solutions, alongside innovative, multi-strategy, total return approaches.

We believe that diversification shields investors from market volatility. That's why our multi-asset offering encompasses our skills across both traditional and alternative asset classes.

This means our multi-asset strategies are geared to investors interested in protecting their portfolios from the risk exposure inherent in unpredictable market swings, while at the same time stabilizing investment returns.

Higher correlations between markets today require rethinking diversification. Among our asset management firms, we offer innovative, multi-strategy approaches alongside more traditional balanced strategies.

The Strategies

Traditional balanced

Absolute return multi-asset

Total return multi-asset

Bespoke LDI solution

Funds-of-funds

Liquid alternatives UCITS