Active Ownership

We have developed skills in active ownership that aim to seize the best investment opportunities and build more resilient portfolios with better long-term risk-adjusted returns, having in mind the sustainability requirements of our clients

Our active ownership experts within Generali Investments ecosystem

GIAM’s Approach

To promote investee companies’ sustainability practices and good governance by making an impact at general meetings and through relationship with companies: that’s the main objective of GIAM’s active ownership activity.

We want to drive significant and real progress through capital allocation decisions, stewardship and successful engagement with companies and fellow investors, contributing to risk mitigation and creation of value for our clients.

GIAM acts on two levels:

VOTING ACTIVITY

ENGAGEMENT WITH COMPANIES

2021 Public engagements

SHAREHOLDERS MEETING

COUNTRIES COVERED

AGAINST VOTES

BONDHOLDERS MEETING

RESOLUTIONS VOTED

2021 Figures

Engagement by ESG Topics

Governance 34,45%

Social 14,19%

Human Rights 5,7%

Environments 22,29%

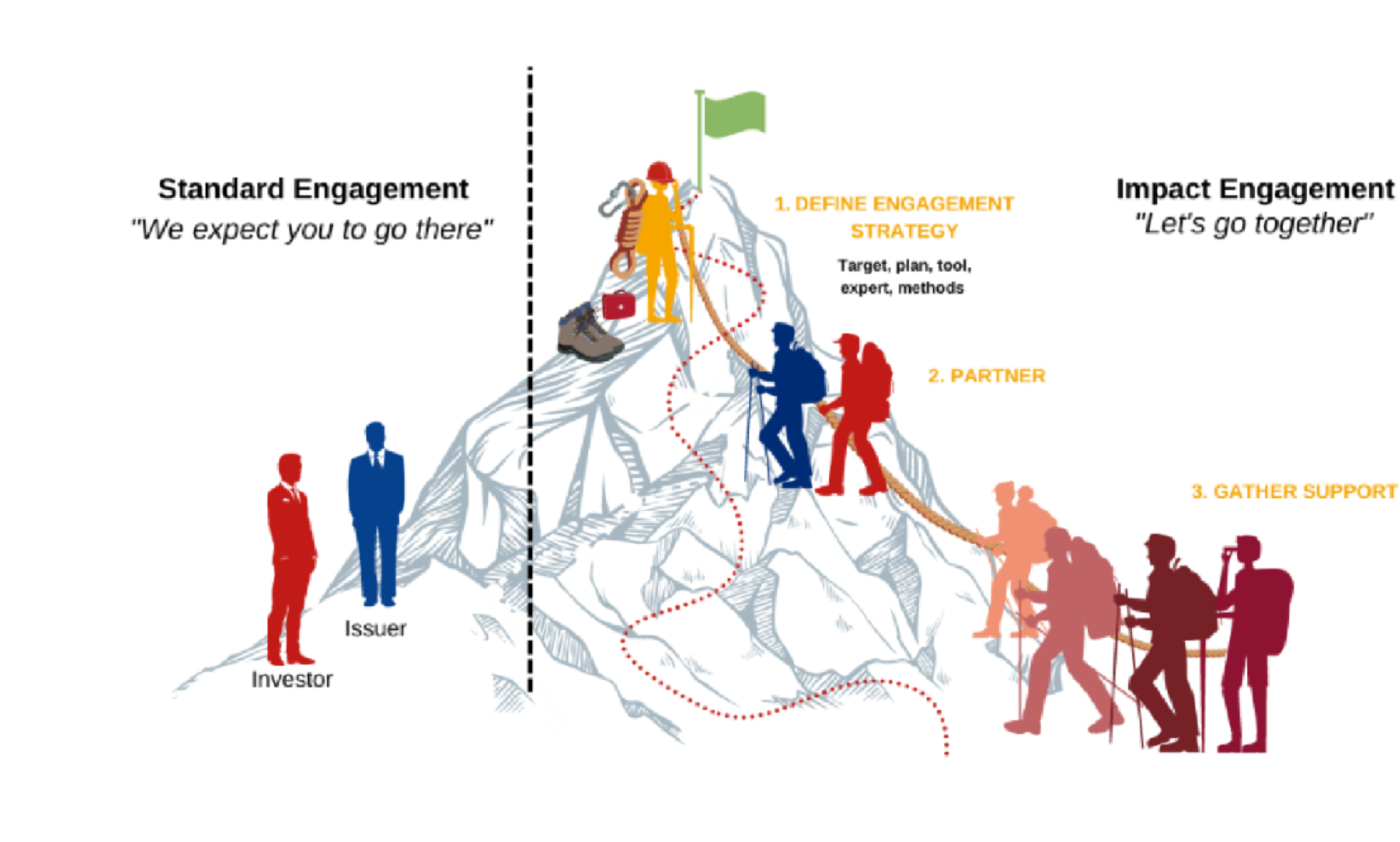

Standard vs Impact Engagement

Standard 12,16%

Impact 63,84%

Engagement by country

France 29,39%

Italy 25,34%

Germany 7,1%

UK 4,5%

Spain 3,4%

USA 2,3%

Poland 1,1%

Switzerland 1,1%

Czech Republic 1,1%

Norway 1,1%

Papou New Guinea 1,1%

Engagement by type

Collab 29%

Dual 4%

Direct 67%

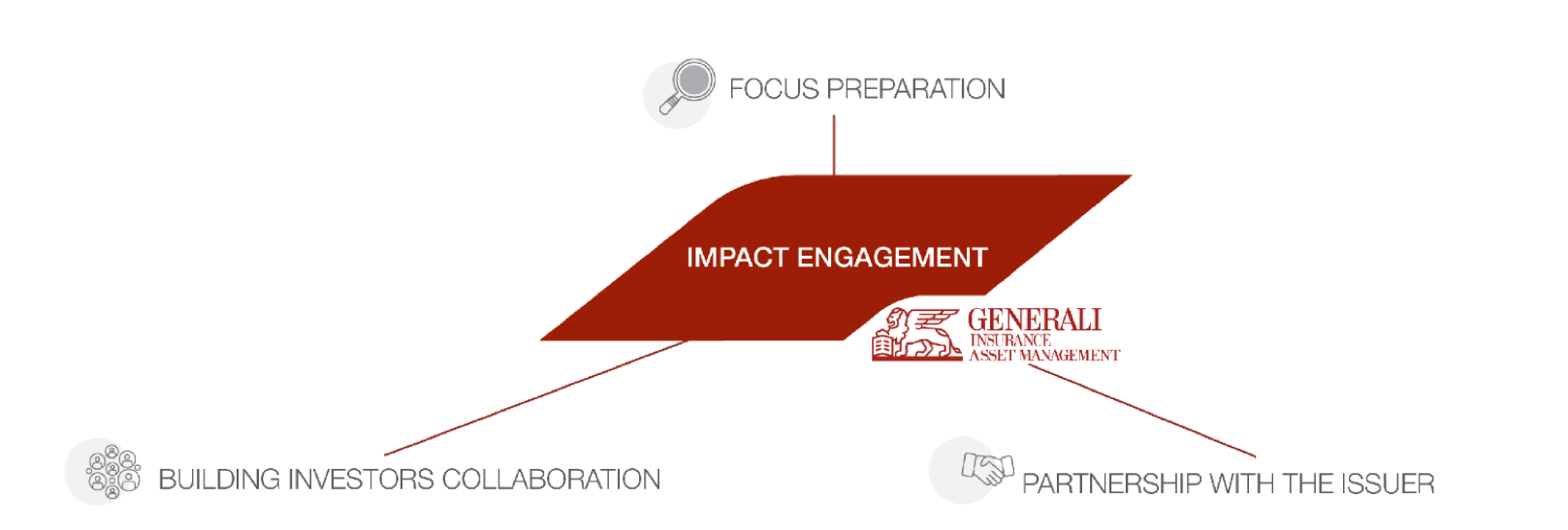

3 pillars of impact engagements

1 - Focused preparation to create added value

The first pillar is preparation. To maximize "return on commitment", the focus is on the largest exposures, with the highest ESG risk, with a probability of significant engagement success. One or two topics are prioritized, aiming to avoid dispersion. We try to begin with a level of expertise that will allow us to create a relationship of trust with the company. We strive to involve all internal actors who interact with the company (financial analysts on credit and equities, ESG analysts, portfolio managers) to be able to define an internal view and deliver a coherent message to each interaction. The result of this iterative process is the identification of tipping points, tools and experts that are potentially useful to the business.

2 - Building a partnership to create common added value via negotiation

The second pillar is the creation of a partnership relationship with the company. We must first overcome the historical vicious circle that links company and investors: the investor judges, the company has a perfect façade and therefore the investor is suspicious. This goes through very human mechanisms where preparation creates a ground of trust, until the moment when the company agrees to work with us, and says "I don't know, let's work together", for example.

The biggest added value comes from negotiating a priori irreconcilable point of view. This requires a lot of listening, creativity and a spirit of innovation, without giving up the initial requirement. The result of this step is the definition of a concerted plan with the company to address expectations.

3 - Creating or joining coalition of investors

The third pillar is the creation (when possible) of a coalition of investors. We only use this tool once we have defined a framework with the company. This avoids the pitfall of the “lowest common denominator” effect. Several times a company itself has offered to bring together other investors around the defined framework to accelerate the change that is taking place internally. This continues the dynamic of collaboration that facilitates the recognition of our impact. Finally, we ensure that the governance of this collaborative initiative is clear in terms of duties (efforts) and rights (recognition if successful).

CEZ: a successful case study

In June 2020, during the ČEZ General Assembly, we stressed to CEZ the importance of validating their strategy by the "Science Based Target Initiative" (SBTi). We held an introductory workshop between ČEZ and CDP (which coordinates the SBTi), suggesting that our fellow Climate Action 100+ investors join us as well. As part of our CA100+ discussions, as co-lead, we reiterated this expectation. Finally, in January 2022, we met Kateřina Bohuslavová, new Head of Sustainability at ČEZ to once again highlight the importance of SBTi.

This year, on June 23, ČEZ publicly announced that it had obtained the Science Based Target validation "well below 2°C by 2030" for its climate strategy to 2030 (carbon intensity reduction from 0.38tCO2 per MWh in 2018 to 0.16 in 2030). While we would be in favor of an alignment at 1.5°C, such a result for a company with 4.8 GW of coal in 2020 (8.1 GW in 2015 and an exit now planned in 2038) and 37% of coal in the energy mix is an excellent example for all emitters in countries whose energy mix is heavily dependent on coal. Knowing the many geographical constraints in the Czech Republic and given the geopolitical situation, it is worth stressing the importance of this result.

“The cooperation between ČEZ and Generali has been successfully continuing for the fifth year. Ongoing dialogue with Generali on one-on-one basis and also within CA100+ initiative helped us to further improve our communication on our coal exposure and emissions reduction. This feedback from investors and also from financing banks contributed significantly to ČEZ Group’s decision to modify its strategy and put more emphasis on ESG topics. As a result we published accelerated strategy of ČEZ Group under new name Clean Energy for Tomorrow in May 2021. This strategy includes more ambitious commitments on decarbonisation, which will be enabled by faster closure of our coal plants and 6000 MW of new renewables capacity by 2030. This strategy also increased our focus on ESG policies and set specific ESG KPIs.

We particularly valued our discussions with Generali on the importance of setting emission reductions targets in-line with the SBTi guidelines. Following the announcement of the accelerated strategy, we were able to send a commitment letter to SBTi, join their initiative Business Ambition for 1.5°C. 1 and submit our carbon reduction targets for validation. All these steps were taken in 2021 and our cooperation with Generali and CA100+ helped in onboarding relevant people within ČEZ Group.”

Barbara Seidlová, Testimony of CEZ Head of Investor Relations – March 2022

See also: the joint statement between CEZ and CA100+ investors, including Generali Investments.