Another 25 bps ECB hike but GC undecided between hike or pause in September

In Kürze

Highlights:

- At today’s meeting the ECB’s Governing Council (GC) unanimously agreed to lift its key rates by another 25 bps, in line with expectations. It stuck to its intention of PEPP reinvestments at least until the end of 2024 but more surprisingly lowered the remuneration of minimum reserves to 0%. Also, President Lagarde mentioned that the ECB is likely to sell climate laggards after summer.

- As in the previous meeting, inflation is seen as “too high for too long”. However, the GC is less determined on further rate hikes. It merely speaks of rates “set at sufficiently restrictive levels” instead and no longer sees that they need to be “brought” there.

- Also, the GC now assesses the transmission of past policy increases as “forcefully” stating that tighter financing conditions “are increasingly dampening demand” while near-term economic weakening is acknowledged.

- In the Q&A President Lagarde this time adopted a truly data dependent approach and there was no talk about more ground to cover. Instead, she hinted at additional inflation data and the updated macro projections available at the September meeting.

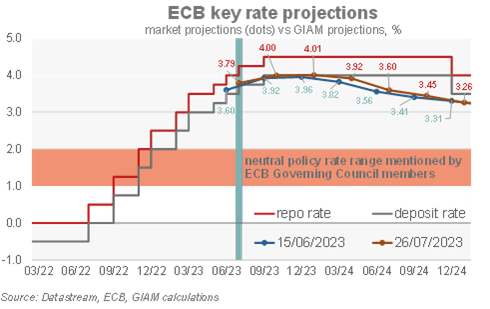

- Overall, the tone was much more balanced than at previous meetings. For the September 14 meeting, only a cut was excluded but a pause or a further hike were explicitly mentioned. This makes our call of a further 25 bps hike to 4.0% a very tight one. Inflation data and the updated ECB macro projections will be key.

A 25 bps rate hike today: At today’s meeting the GC lifted its key rates by another 25 bps thereby bringing the deposit rate to 3.75% and the repo rate to 4.25%. While continuing with APP non-reinvestments it stuck not to change stance on PEPP reinvestments until year-end 2024 at least and set the remuneration of minimum reserves to zero. Since October 2022 they were remunerated according to the deposit facility rate. Also, in the Q&A President Lagarde mentioned that the ECB is likely to sell climate laggards after summer.

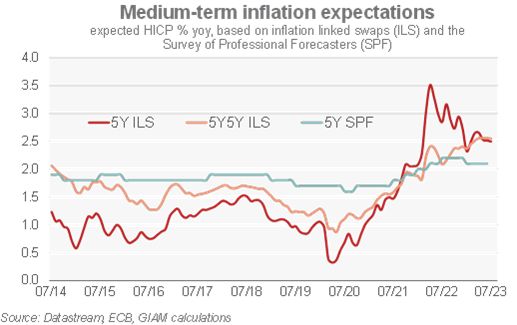

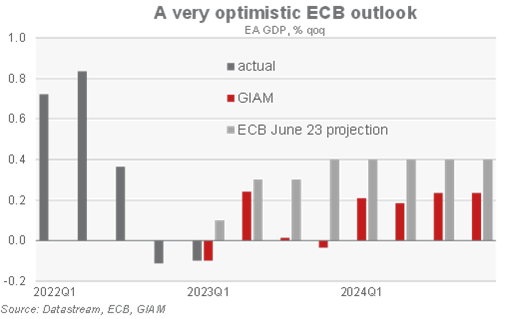

Macro data challenge ECB projections: Since the last policy meeting inflation continued to trend down further (to 5.5% yoy in June) while key sentiment indicators like the composite PMI (July flash estimate of 48.9) show a stalling of activity with even the risk of receding output. Especially the activity data are at odds with the rosy outlook provided by the June projections according to which activity recovers to potential and stays there throughout 2024. At today’s meeting the GC acknowledged that the near-term economic outlook deteriorated and that the labour market dynamics might weaken and even become negative in manufacturing. However, it argued that “falling inflation, rising incomes and improving supply conditions should support the recovery” again. Underlying inflation (of 5.5% yoy) remains a cause for concern but the 2024 projected headline inflation rate of 3.0% is clearly above consensus and our proprietary expectation (of 2.4%/ 2.5% yoy). The ECB emphasises the shift from external (energy, food) to domestic (e.g., wages) sources of inflation. Overall, it became clear there are also increasing doubts within the GC about the latest rosy ECB macro projections.

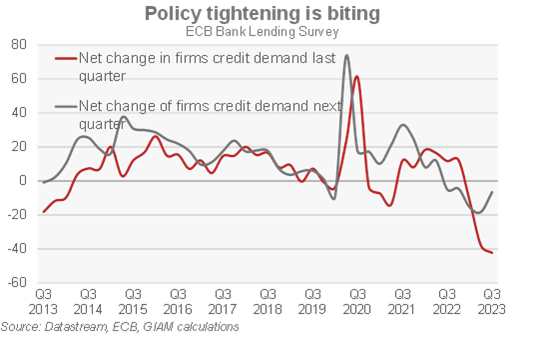

Passing through of tighter policy: At the same time there is increased indication that policy tightening works its way through the economy. For instance, loan growth to households (of 1.7% yoy in June) and firms fell to the lowest since May 2016 and November 2021 while the latest Bank Lending Survey hints at a further moderation of credit demand. The GC acknowledged this. While at the June meeting, it stated that it no longer sees uncertainties regarding the effect of its policy but sees it “gradually having an impact across the economy. It now assesses transmission of the past policy increases as “forcefully” stating that tighter financing conditions “are increasingly dampening demand”.

GC is now truly data-dependent: As in former meetings the GC stuck to a data-dependent approach. However, this time the ECB adopted a truly data-dependent approach in our view. At past meetings, President Lagarde had mentioned that more ground was to cover. This time she did not reiterate that but asked in the Q&A stated that she currently would not say so. Instead, she very much emphasized the incoming data with inflation data and updated macro projections mentioned prominently. Consequently, the GC merely speaks of rates “set at sufficiently restrictive levels” and no longer sees that they need to be “brought” there.

End of the hiking cycle ahead but rate cuts not to come on the table soon: With today’s 9th consecutive hike, key rates advanced by cumulatively 425 bps since July. Rates are now well into restrictive territory. We still have a further 25 bps rate hike in our books but acknowledge that given today’s press conference this has become a close call as we think that the ECB macro projections will need to be revised substantially down in September. In any case, we continue to think that in Q3 the peak policy rate will be reached. We expect communication to emphasize the need for the peak rate to stay at its level for longer and look for a first rate cut only towards the end of 2024.