Les dernières vues, perspectives et idées d'investissement des experts de notre plateforme.

Rethinking innovation in Europe

Investors naturally associate innovation with multi-billion dollar market cap digital technology companies on the West Coast and in China. But away from what I believe to be overvalued and crowded FAANGs1, lies Europe – where clusters of innovation seem to be thriving under the radar. From Industry 4.0 in Germany to renewables in southern and northern Europe, to life sciences and pharmaceuticals in Switzerland, I see the ‘old continent’ as an extraordinarily rich soil in which we can discover mispriced innovative companies.

In the Aperture European Innovation Fund2, we attempt to broaden the scope of what innovation means. In my view, the rapid advancement and ubiquity of technology means that the line distinguishing tech stocks from other sectors is becoming blurry and it no longer makes sense to look at individual sectors or themes when gaining exposure to innovation, such as robotics and fintech, for example. That’s why I try to focus on fundamental, bottom-up stock-picking to select the European companies that I believe are leading global innovation and are set for long-term growth, whatever the sector may be.

Picks and shovels

Broadly speaking, Europe may typically be characterised as a manufacturing continent and it is home to many of the world’s oldest companies. This may matter when it comes to assessing innovation, because while start-ups and disruptors grab the headlines, it is the so-called ‘dinosaur’ companies that have the scale to acquire and adopt these disruptive technologies on a mass scale. In addition, there are many companies in Europe that manufacture the components behind the big-name Silicon Valley companies. They are less visible than the Teslas of the world, but they are essential to the powering the adoption of new technologies.

An example is in the semiconductors space. Given the global penetration of electric vehicles is still only one percent, this is one exciting area that is still right at the beginning of a massive innovation curve. Typically, when an innovative technology emerges, adoption is low before increasing exponentially when it becomes mass market. These ‘picks and shovels’ are the critical infrastructure that will enable the technological revolution.

Another interesting area of manufacturing that gained critical importance over the pandemic has been life science bioreactors, which are essentially large tanks with the right biological conditions to proliferate cells for use in vaccines and a variety of drugs. Bioreactor systems are essentials for the drugs of the future. There are companies in France and Germany that I would consider to be leading the way in the sector.

As a fundamental stock-picker, I will attempt to allocate to both older established companies and the start-up. For example, Stellantis3, which formed from the merger of Peugeot and Fiat Chrysler earlier this year, from what we see is one of the most profitable mass car market OEMs in the world and also one of the cheapest in terms of valuations; it’s also leading the way in terms of sustainable mobility solutions as they embrace electrification, connectivity, autonomous driving and shared ownership.

The very nature of technological growth tends to be exponential, rather than linear. Because of this, investment opportunities lie across a vast range of sectors. Looking ahead, I’m excited about innovation in healthcare, mobile transportation, renewable energy, education, and the many ways in which AI, machine learning and 5G are transforming all industries they touch.

Innovation remains a deflationary force

After almost a decade and a half of low interest rates, the cheap access to financing has benefited innovation and inventiveness. As we enter the reversal phase of tapering and higher rates, innovation adoption should continue at pace: 5G Open RAN for enterprises is in its early days and we are only just getting acquainted with the ‘metaverse’ world, to name just a few examples. Meanwhile, on a longer term basis, looking beyond current disruption, new technologies such as blockchain have the potential to ‘debottleneck’ supply chains by enabling instant connectivity and greater logistics transparency.

As the consensus narrative starts to build a wall of worry about rampant inflation, the adoption of multiple innovations inevitably accelerating should continue to act as a deflationary force, this time helpfully counterbalancing rising costs. In the first nine months of 2021 for example, American factories and industrial users ordered a record 29,000 robots valued at $1.48 billion. This is more than the previous pre-pandemic peak set in 2017, according to data compiled by the Association for Advancing Automation4.

Valuations: P/E vs. EV/Sales

Inflation and rising rates generally hit growth stocks the hardest. However, stocks where revenue growth is financed with negative earnings and/or cash flows are likely to face an even higher hurdle rate, especially if they require further funding to establish sustainable margins. In what can be considered the growth segment, this is an area where Europe seems particularly cheap with less than 15% of the MSCI Europe IMI Growth index having loss-making stocks vs. over 60% of US Russell 3000 Growth stocks5.

Anis Lahlou

Fund Manager

Anis Lahlou is a Chief Investment Officer based in Aperture’s London office and the fund manager of Aperture European Innovation Fund. Prior to joining Aperture, Anis spent 20 years with J.P. Morgan where he was a managing director and a senior investor.

For 14 years he managed unconstrained European equities funds with a primary focus on broad technology strategy, long-only and long/short. Anis has developed a passion for all technology-oriented trends and spends his time researching disruption with broad, global implications. He is a CFA Charterholder and received his Masters in Business and Economics from ESSEC in Paris.

1FAANG”: Acronym for Meta (formerly known as Facebook), Amazon, Apple, Netflix and Alpha (formerly known as Google)

2A compartment of Aperture Investors SICAV Bet

3As of Nov 26, 2021, the European Innovation Fund has a position of less than 1% O/S in STLA.

4Source: BusinessWire, November 2021

5Source: GMO, Aperture Investors as of November 2021

Investments involve risks. Past performance is not a reliable indicator of future performance and can be misleading. There can be no assurance that an investment objective will be achieved or that there will be a return on capital. You may not get back the amount initially invested. Before taking any decisions please refer to the associated legal documents.

The management company is Generali Investments Luxembourg S.A. who appointed Aperture Investors as investment manager.

Management Company and Investment Manager

€ 521 M

AuM

UCITS

Structure

Luxembourg

Domicile

December 17th, 2019

Inception date

Daily

Liquidity

Euro

Currency

I EUR Dist.

Share Class

LU2077747074 (IX EUR Acc.)

ISIN

MSCI Europe Net Total Return EUR Index

Benchmark

0.30%

Management fees

30% > benchmark

Performance fees

- Main risks: Sustainable finance risk - Market risk - Volatility risk. Due to the exposure of the Sub-fund to financial derivative instruments the volatility can at times be magnified – Derivatives – Equity – Investment in small companies amongst others.

Aperture Investors, based in New York, is a global asset manager founded in 2018 by a partnership between Generali Group and Mr Peter Kraus, former Chairman and CEO of AllianceBernstein. Aperture operates with an unconstrained investment approach and a unique fee model that aligns the company’s profitability with that of its clients. The company charges low, ETF-like fees when performance is at or below stated benchmarks. When and only when returns are generated in excess of a strategy’s benchmark, Aperture Investors charges a performance-linked fee, and as such, investment teams are compensated primarily on outperformance.

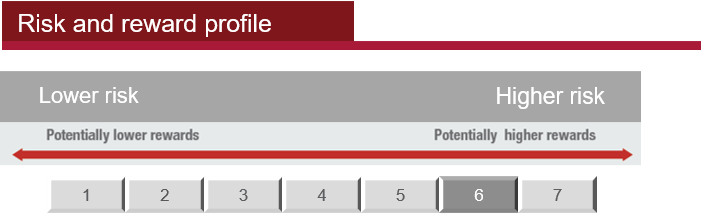

This indicator represents the annual historical volatility of the Fund over a 5-year period. Its aim is to help investors understand the uncertainties attached to gains and losses that may have an impact on their investment. The Fund's diversified exposure to short term debt instruments explains its classification in this category. Historical data such as that used to calculate the synthetic indicator cannot be considered as a reliable indication of the Fund's future risk profile. The risk category associated with the Fund is not guaranteed and may change over time. The lowest risk category does not mean "risk free". Your initial investment is not guaranteed.

Significant risk(s) for the Fund not taken into account in this indicator include the following:

Counterparty Risk: The Fund primarily concludes derivatives trades with various contracting parties. There is a risk that counterparties may no longer be able to honour their payment or settlement obligations. Operational Risk and Depositary Risk: The Fund may fall victim to fraud or other criminal acts. It may also incur losses due to misunderstandings or errors by employees of the management company, the depositary or external third parties. Finally, its' management or the custody of its' assets can be adversely affected by external events such as fires, natural disasters etc.

For more information about the risks of the Fund, please refer to the risk section of the prospectus.

Investments involve risks. Past performance is not a reliable indicator of future performance and can be misleading. There can be no assurance that an investment objective will be achieved or that there will be a return on capital. You may not get back the amount initially invested. Before taking any decisions please refer to the associated legal documents.

Sources of the data (unless specified otherwise): Aperture

Marketing communication issued by Generali Investments Partners S.p.A. Società di gestione del risparmio. This webpage refers to the Fund Aperture Investors SICAV (the "Fund") and its compartment European Innovation Fund (the "Compartment"). This document is only intended for professional investors in Austria, France, Germany, Italy, Spain as defined in the Directive 2014/65/EU on Markets in Financial Instruments Directive (MiFID), it is not intended for US Person. Investors must read the Prospectus (available in English) and KIIDs (available in the language of the country of residence of the investor) and particularly the risks, costs and conditions, before making any final investment decisions. The documents are accessible free of charge on www.generali-investments.com. The future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future. Access to a summary of your investor risks including common actions in case of litigation at EU and national level on this website as well (in English and in the language of residence of investors). Absence of legal, tax or investment advice within this content. The Management Company, Generali Investments Luxembourg S.A., has the right to terminate the arrangements for distribution of any product at any time. All information and opinions contained in this Document represent the judgment of the author at the time of publication and are subject to change without notice. The views expressed are those of the author but may not be the views of Aperture Investors UK, Ltd and its parent company Aperture Investors, LLC (“Aperture”). Aperture Investors SICAV: Luxembourg UCITS-SICAV subject to the Luxembourg law of 17 December 2010 relating to undertakings for collective investment, as amended. Aperture Investors SICAV – European Innovation Fund: aims to generate superior long-term risk adjusted returns in excess of the MSCI Europe Net Total Return EUR Index by investing in a portfolio exposed essentially to European equities and equity-related instruments. - Actively managed - Main risks: Sustainable finance risk - Market risk - Volatility risk. Due to the exposure of the Sub-fund to financial derivative instruments the volatility can at times be magnified – Derivatives – Equity – Investment in small companies amongst others - Risk & Reward Profile (class IX, acc): 6 (High to Very High volatility) - Main costs of this class: Entry fee: 5% - Exit fee: 1% - Ongoing charge: 0,43% - Performance fee : 30% per annum of the positive return above the Performance Fee Benchmark (SOFR + 2%) - Fund Currency: EUR – Class registered in: IT, ES, FR, DE, AT - Benchmark: MSCI Europe Net Total Return EUR Index . Warning: Past performance does not predict future returns – In case of derivatives, the use of leverage may increase the risk of potential losses or increase return potential - Returns may increase or decrease as a result of currency fluctuations – The presented Funds are not guaranteed products, meaning a risk to lose part or all of the initial investment.

© 2021 - Generali Investments Partners S.p.A. Società di gestione del risparmio.

© Generali Investments, tous droits réservés. Ce site web est géré par Generali Investments Holding S.p.A. en tant que société holding des sociétés de gestion d'actifs du Groupe Generali ayant, directement ou indirectement, une participation majoritaire dans les sociétés énumérées ci-dessous (ci-après dénommées conjointement "Generali Investments"). Ce site web peut contenir des informations relatives à l'activité des sociétés suivantes : Generali Asset Management S.p.A. Società di gestione del risparmio, Infranity, Sycomore Asset Management, Aperture Investors LLC (y compris Aperture Investors UK Ltd), Plenisfer Investments S.p.A. Società di gestione del risparmio, Lumyna Investments Limited, Sosteneo S. p.A. Società di gestione del risparmio, Generali Real Estate S.p.A. Società di gestione del risparmio, Conning* et ses filiales Global Evolution Asset Management A/S - y compris Global Evolution USA, LLC et Global Evolution Fund Management Singapore Pte. Ltd - Octagon Credit Investors, LLC, Pearlmark Real Estate, LLC ainsi que Generali Investments CEE. *Englobe Conning, Inc, Conning Asset Management Limited, Conning Asia Pacific Limited, Conning Investment Products, Inc, Goodwin Capital Advisers, Inc (désignés comme "Conning").