Les dernières vues, perspectives et idées d'investissement des experts de notre plateforme.

Capabilities

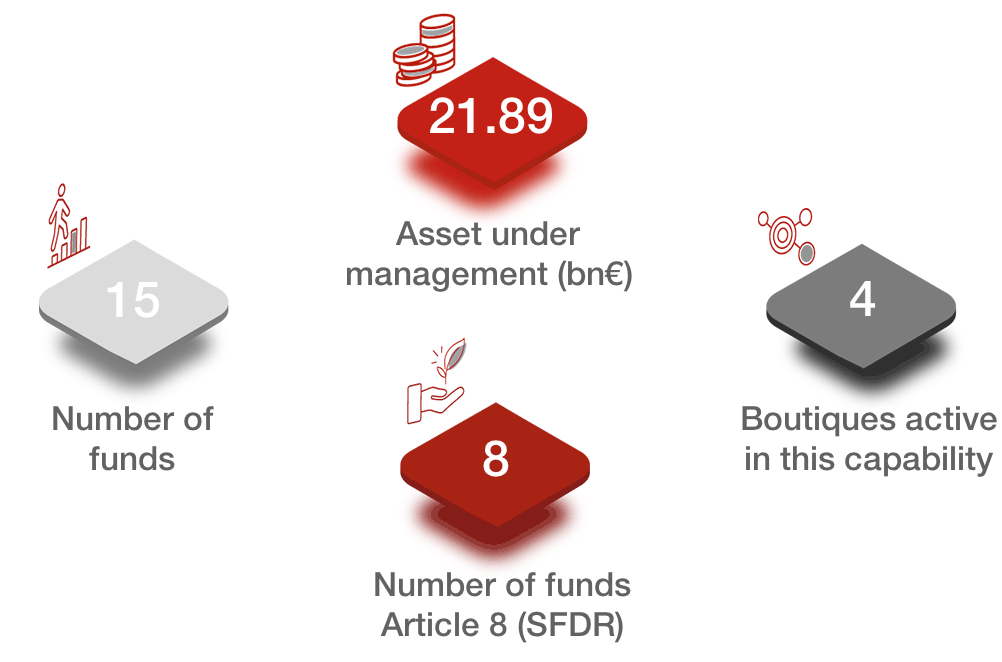

Our multi-asset range offers traditional, balanced strategies and bespoke LDI solutions, alongside innovative, multi-strategy, total return approaches.

We believe that diversification shields investors from market volatility. That's why our multi-asset offering encompasses our skills across both traditional and alternative asset classes.

This means our multi-asset strategies are geared to investors interested in protecting their portfolios from the risk exposure inherent in unpredictable market swings, while at the same time stabilizing investment returns.

Higher correlations between markets today require rethinking diversification. Among our asset management firms, we offer innovative, multi-strategy approaches alongside more traditional balanced strategies.

Traditional balanced

Absolute return multi-asset

Total return multi-asset

Bespoke LDI solution

Funds-of-funds

Liquid alternatives UCITS

© Generali Investments, tous droits réservés. Ce site web est géré par Generali Investments Holding S.p.A. en tant que société holding des sociétés de gestion d'actifs du Groupe Generali ayant, directement ou indirectement, une participation majoritaire dans les sociétés énumérées ci-dessous (ci-après dénommées conjointement "Generali Investments"). Ce site web peut contenir des informations relatives à l'activité des sociétés suivantes : Generali Asset Management S.p.A. Società di gestione del risparmio, Infranity, Sycomore Asset Management, Aperture Investors LLC (y compris Aperture Investors UK Ltd), Plenisfer Investments S.p.A. Società di gestione del risparmio, Lumyna Investments Limited, Sosteneo S. p.A. Società di gestione del risparmio, Generali Real Estate S.p.A. Società di gestione del risparmio, Conning* et ses filiales Global Evolution Asset Management A/S - y compris Global Evolution USA, LLC et Global Evolution Fund Management Singapore Pte. Ltd - Octagon Credit Investors, LLC, Pearlmark Real Estate, LLC ainsi que Generali Investments CEE. *Englobe Conning, Inc, Conning Asset Management Limited, Conning Asia Pacific Limited, Conning Investment Products, Inc, Goodwin Capital Advisers, Inc (désignés comme "Conning").