Investment Capabilities

LDI Expertise

Working with you to manage liability risk

Generali Group Mandates

€316bn AUM

External Mandates

€38bn AUM

Strategic Generali Participations

€42bn AUM

We aim to help our clients meet the competing objectives of generating income while optimising capital efficiency.

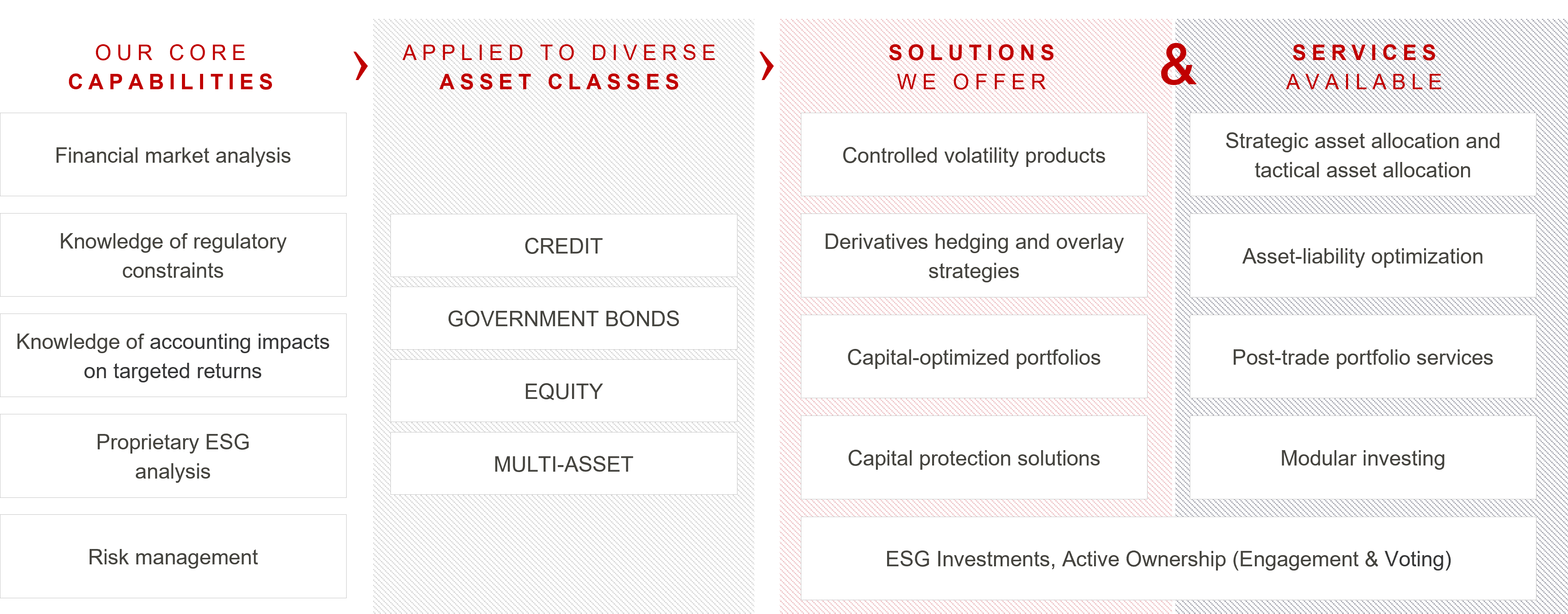

Regulatory and accounting expertise and managing downside risk is in our company DNA and provide the foundations for our LDI approach. Drawing on our key capabilities, we provide tailored investment solutions and services for the unique investment challenges of our clients that can evolve as their needs progress.

Our goal is to develop a tailored strategy for our clients that focuses on the behaviour of the total asset portfolio, fits their organization and delivers long-term value.

How do our investment solutions come to life?

Drawing on our key capabilities, we provide tailored investment solutions and services for the unique investment challenges of our clients

Services

Source: Generali Insurance Asset Management S.p.A. Società di gestione del risparmio as at December 2022.