Country note: Ghana

In Short

By Anne Margrethe Tingleff, Senior Portfolio Manager, Global Evolution

We visited Ghana’s capital, Accra, in late Jan 25 just one month after the general election. We met with government officials, central bankers, and local corporates to gain a deeper understanding of the economic outlook under the new administration. Although the IMF did not believe there was much in the way of hidden debt (including arrears), the new administration is undertaking a process to reconcile fiscal numbers, which is expected to show a modest deterioration in public finances. However, the new administration appears determined to deliver fiscal reform necessary to restore order to public finances and keep the IMF program on track. The new administration also inherited an improving external balance, with a CA surplus enabling a gradual rebuilding of FX reserves. With election pressure on expenditure less of a priority moving forward, it appears likely that the post-crisis stabilization and gradual economic normalization are set to accelerate. Our main concerns remain fiscal. It is still unclear how much expenditure rose in the lead-up to the election. This, combined with continued fiscal pressure from energy sector arrears, adds to the uncertainty. We left Ghana cautiously constructive on debt investment opportunities moving forward.

Politics: Will This Time Be Different?

In December 2024, Ghana held its general election, resulting in a victory for the opposition. Former President John Mahama returned to office, becoming the first in Ghana to serve two non-consecutive terms. During his previous tenure (2012–2017), the economy experienced strong growth but faced fiscal mismanagement, external shocks, and rising debt.

Interesting, President Mahama is now presenting himself as the leader of a fiscally responsible party, after the previous NPP government needed to go to the IMF for financing and restructure public debt to prevent an even greater economic crisis.

The previous government secured a USD3.0bn IMF loan in 2022 contingent on restructuring both local and external debt to restore debt sustainability.

Under pressure from the IMF and external bond owners, the authorities restructured domestic bond holdings via an exchange program in 2023. In an unusual departure from international domestic bond market norms, the exchange delivered a principal haircut.

Although the process did assist in getting IMF calculations to acceptable levels of debt sustainability, it did effectively destroy the nascent domestic bond market, forcing the authorities to rely heavily on the short-term paper for financing.

After three years of negotiations with the IMF and creditors, the country successfully restructured its Eurobonds in Oct 24, together covering 96% of its debt. The sovereign still has commercial debt worth some USD2.8bn where the restructuring is still unresolved.

The government also faces contingent liabilities to energy companies over arrears that the government is disputing in the courts. Reforming the energy sector and particularly dealing with the tariff system remains a key IMF condition. However, vital reforms across the sector and the large state-owned Electricity Company of Ghana (ECG) and being held up by political and regulatory hurdles as the Public Utilities Regulatory Commission (PURC) board is currently dissolved.

Economic Growth: Strong Recovery

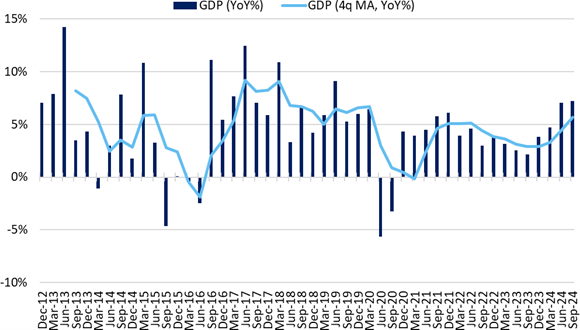

Ghana's post-COVID recovery saw 6.1% GDP growth in 2021, but momentum slowed to 3.8% in both 2022 and 2023 amid ongoing debt restructurings. Despite subdued growth in 2023, the industrial sector showed signs of recovery, driven by a rebound in resource- based industries.

That said, growth picked up into the elections in late 2024, with GDP registering 7.2% y/y in Q3:24. Although fiscal spending boosted services and construction, the economy was also boosted by the mining sector that was up a huge 17.1% y/y in Q3:24.

Chart 1: Real GDP Growth (%YoY & %YoY, 4q sum)

Source: Haver, Global Evolution

Gold mining companies have increased production over the past year, and the commissioning of new mines is expected to further boost output in the medium term. Additionally, a lithium project investment is set to support economic activity from 2026 onward.

However, the key cocoa sector struggled in 2024. Despite high cocoa prices, unfavorable weather and disease reduced output. According to Cocobod, Ghana’s government agency for cocoa production, output is expected to rebound in the 2024/2025 season, with improved weather conditions supporting stronger production.

Download the full publication:

Research Disclaimer

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution

Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or

indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Managment A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Legal Disclaimer ©2025 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.