Country note: Thailand

In Short

By Alexander Friis Illum, Senior Analyst

We visited Bangkok in late November 2024 to meet with government officials, central bankers, and local analysts. Decades of political uncertainty, marked by military coups and frequent changes in government, have hindered structural reforms and investments in key industries. While the political landscape appears to have stabilized for now, offering the government an opportunity to adopt a longer-term focus, the impact of ongoing initiatives, such as the Eastern Economic Corridor project, remains to be seen. At the same time, the government continues to prioritize short-term measures like cash handouts, which are contributing to a worsening fiscal situation. We believe Developments in Thailand in 2025 will likely depend heavily on how the government manages risks related to the changing US administration.

Politics: Uncertainty persists

For an IG-rated country with a long history of solid growth, fiscal prudence, and low, stable inflation, Thailand has experienced significant political uncertainty over the past decades. The two military coups in 2006 and 2014 stand out as the most critical events, highlighting underlying instability.

More recently, in August 2024, the Constitutional Court first ruled to dissolve the Move Forward Party, which had won the most seats in the previous year’s general elections. Just a few days later, a separate ruling from the Constitutional Court removed then Prime Minister Srettha Thavisin from office on the grounds of an ethics violation. Early thereafter, Paetongtarn Shinawatra, daughter of former Prime Minister, Thaksin Shinawatra, was chosen as the next Prime Minister.

For now, it appears we are in a relatively stable situation. Shinawatra seems to have prioritized policy continuity, with the initiation of the THB 10,000 handout program notably improving her popularity among the population. However, the ruling coalition consists of 11 parties, making it challenging to establish a consensus on crucial structural reforms. While stability seems to prevail at the moment, such a broad coalition means that renewed instability could arise quickly and without warning.

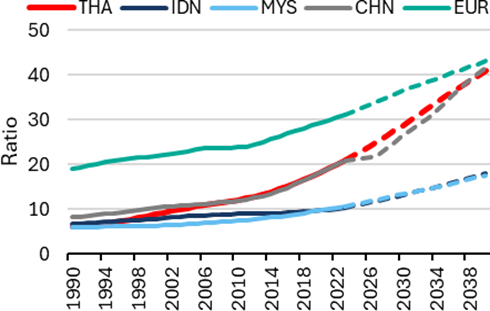

Decades of political uncertainty and frequent leadership changes have led various governments to prioritize short-term "popular" measures over structural reforms. Given the rapidly deteriorating demographic outlook (see chart 1 below), productivity- enhancing initiatives are crucial. The ongoing Eastern Economic Corridor (EEC) infrastructure project exemplifies necessary investments, but more action is needed to boost long-term productivity. We encouraged Ministry of Finance (MoF) officials to focus on education reforms, an area they approached with an open mind despite its political challenges in Thailand, where teachers represent a large and influential voter group but show little appetite for change.

Chart 1: Old age dependency ratio incl. UN forecasts

Note: The UN defines the old age dependency ratio as the number of people aged +65 divided by the number of people aged 15-64 Source: UN, Haver Analytics, Global Evolution

With regard to foreign policy, the main area of attention is the incoming US administration. Thailand is an open economy with trade (exports + imports) accounting for around 135% of total GDP. Tariffs and rising trade protectionism would undeniably pose challenges to the economic outlook. However, Thailand's position in the middle of supply chains would likely make tariffs less impactful than in some neighboring countries. Our analysis suggests that Thailand is unlikely to be hit harder than most other Asian economies by US policies.

Download the full publication:

Research Disclaimer

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution

Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or

indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Managment A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

The information included in the Report may contain statements related to future events or developments that may constitute forward-looking statements. These statements may be in the form of financial projections or may be identified by words such as "expectation," "anticipate," "intend," "believe," "could," "estimate," "will," "should" or words of similar meaning. Such statements are based on the current expectations and certain assumptions of the author and are, therefore, subject to certain risks and uncertainties

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.